Registration Form

Legacy Planning and Gifting Strategies

Actionable Resources

Whether generational wealth transfer, business continuity, or charitable giving, by strategically incorporating life, annuities, and long-term care solutions into your clients’ legacy planning, you can provide opportunities for tax-advantaged protection and growth of assets.

Download the below resources to help enhance and diversify your legacy planning conversations with clients. Then reach out to your Highland representative to get started.

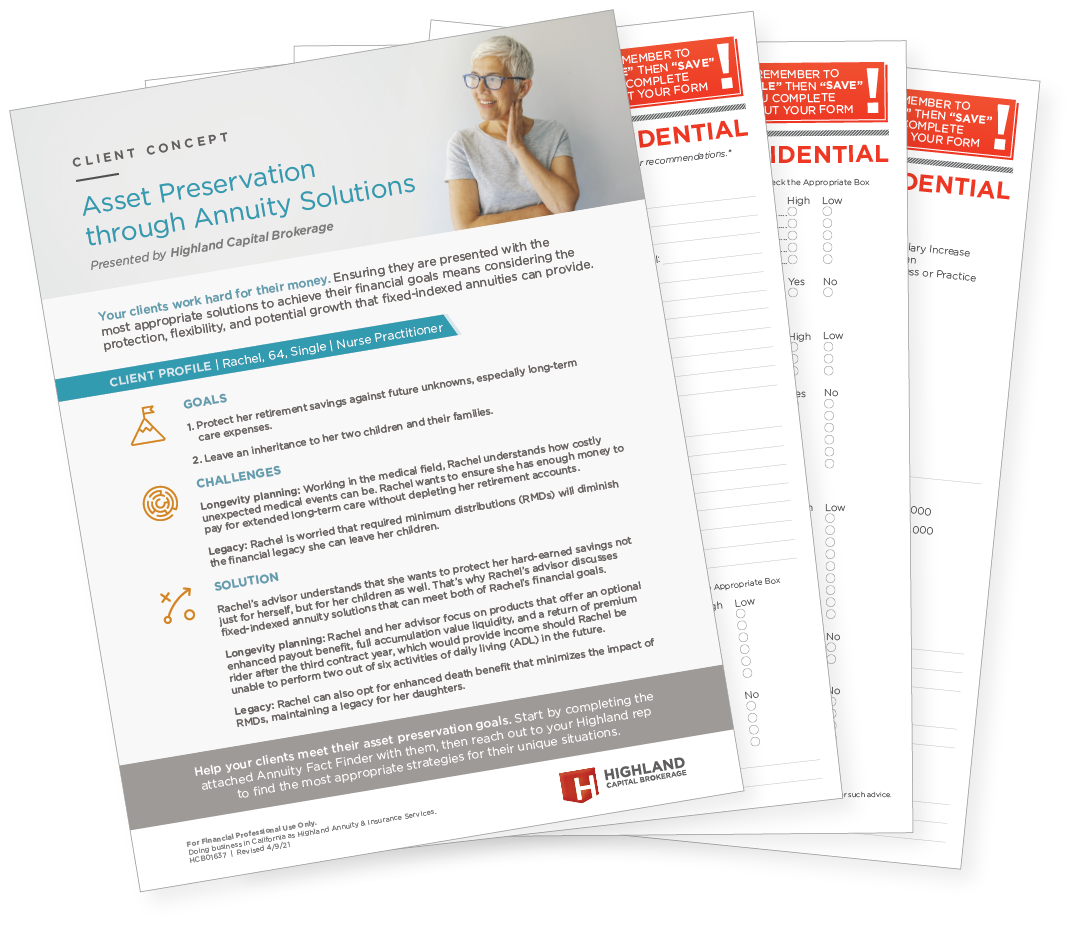

Client Concept: Asset Preservation through Annuity Solutions

Fixed-indexed annuities can provide clients a multi-prong approach to preserving assets. Learn one approach in this client concept resource and then use the Fact Finder to help

determine which annuity solutions may best fit your clients’ goals.