Sometimes strategies can be so simple and basic, yet powerful. For instance, leveraging prior gifts can go a long way in helping families plan for legacies and liquidity for their estate planning needs.

That is, clients who have taken advantage of making gifts to a trust in the past have an opportunity to leverage those gifts with life insurance, provided they can be underwritten medically and financially.

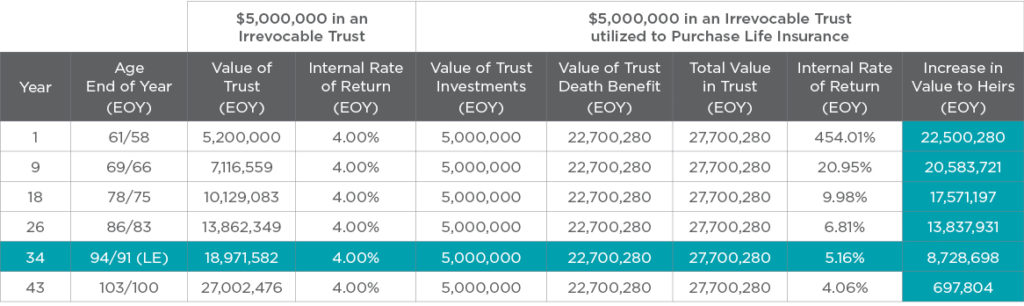

For example, if a client has made gifts in the past to a trust which have now appreciated in value to $5,000,000, a portion of that $5,000,000 can be leveraged with life insurance to increase the value ultimately transferring to the beneficiaries of the trust. The leverage may also be guaranteed to diversify assets of the trust and mitigate volatility to the portfolio.

Assuming the trust allows for the purchase of life insurance, and assuming the trust earns a net after-tax rate of return of 4.0%, the trust may be able to purchase a hypothetical guaranteed Survivorship life insurance policy with a face amount of $22,700,280 on a male, age 60 preferred non-smoker for an annual premium of $200,000.

At age 94/91 joint life expectancy (LE), the trust value — with life insurance — is $27,700,280.

With this approach, the client may be able to increase the amount of wealth transferred to the family by $8,728,698 compared to no insurance.

Take a look:

At your life expectancy of 91, the ILIT value is $27,700,280. With this approach, you may increase the amount of wealth transferred to your family by $8,728,698.

For clients who have existing trusts and want to potentially increase the wealth that passes to the next generation, they may be able to do so by leveraging existing trust assets.

So simple.

To have a sample presentation run, email our Advanced Planning team at advancedplanning@highland.com.

Policies with "guarantees" are subject to the claims paying ability of the issuing insurance company.

All figures are dollars in U.S. currency. The hypothetical case study assumes: Male, Preferred Non-Smoker; the trust earns 4.0 percent net of fees and taxes. Results are for illustrative purposes only and should not be deemed a representation of past or future results.

Trust assets may be insufficient to pay the premiums. In certain situations, additional out-of-pocket contributions to the trust may be required to maintain the desired level of insurance protection.

Gifts in excess of the lifetime exemption of $1,180,000 individual and $22,360,000 married couple for 2019 will be taxable gifts. The exemption is indexed and for 2019 will be $11,400,000/ Individual and $22,800,000/ married couple.

Circular 230 Disclosure: To ensure compliance with requirements imposed by the IRS under Circular 230, we inform you that any U.S. Federal tax advice contained in this communication, unless otherwise specifically stated, was not intended or written to be used, and cannot be used, for the purpose of (1) avoiding penalties under the Internal Revenue Code or (2) promoting, marketing, or recommending to another party any matters addressed herein.

Highland Capital Brokerage and its subsidiaries do not offer tax or legal advice. Clients should consult with their individual tax and legal professionals prior to entering into such transactions.