Registration Form

Client-Ready Estate Planning Resources

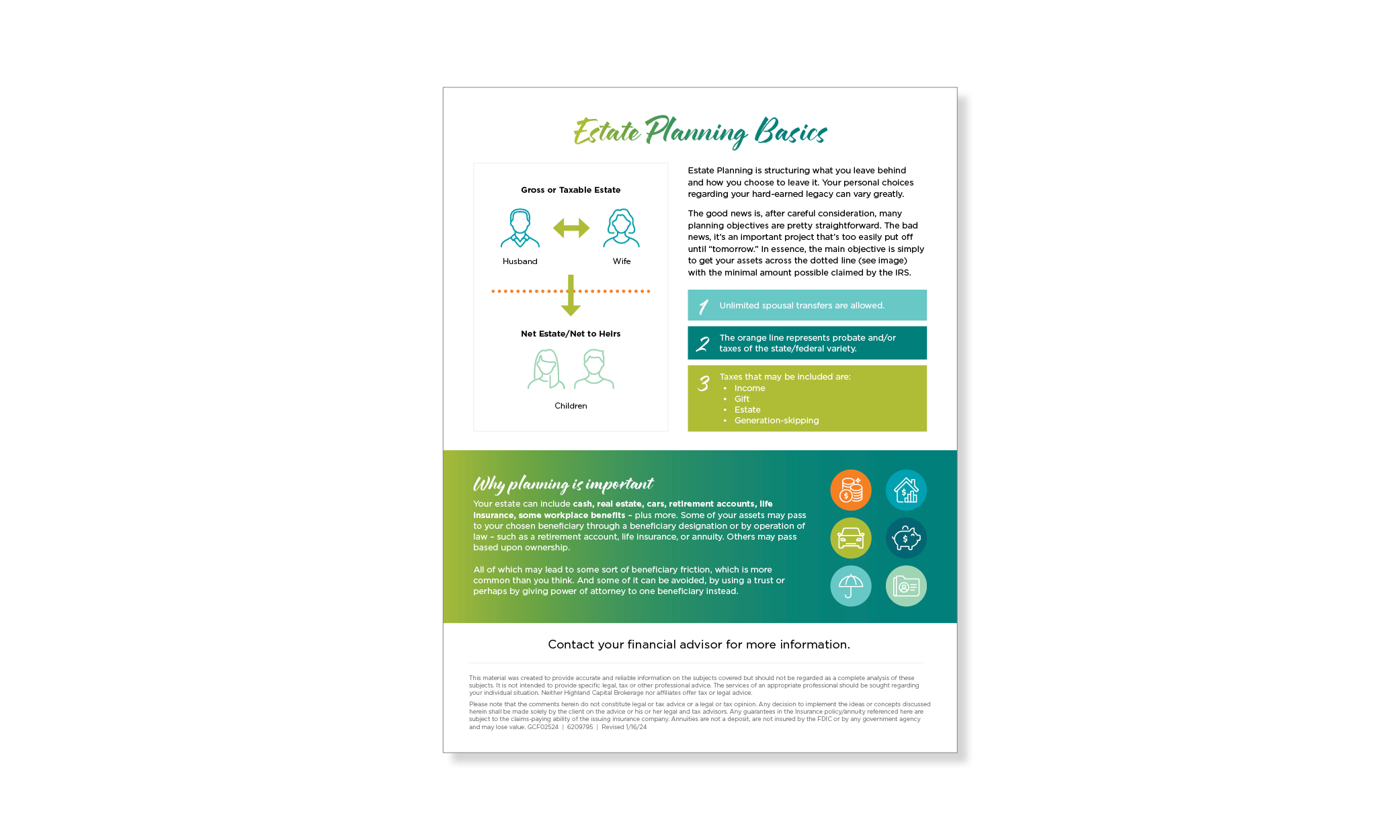

There’s no one-size-fits-all way to plan your estate. You want to protect your beneficiaries, preserve what you worked a lifetime for, and maintain the standard of living for your loved ones, while setting them up for the future. Whatever your motivation, there are a variety of factors to consider – here are a few helpful resources to do just that.